What is a spending account deposit and how is it calculated?

If your employees have access to a spending account (like a Health Spending Account or Lifestyle Spending Account), you’ll have a spending account deposit on your invoice. A spending account deposit is a monthly charge, calculated on the first of the month, to meet the current month's deposit requirements. The deposit is equal to two months of your employee’s total annual spending account allocations and the dates on your invoice typically show last month through to the current month. Why? Our billing system reviews both the current and previous month to calculate the spending account deposit charge or credit on your invoice.

How is it calculated?

Unless otherwise stated in your Master Service Agreement (MSA), we calculate this deposit by using the following equation:

[Total Allocation / 12 months] x 2 months

Why does this amount fluctuate each month?

The deposit amount can fluctuate each month for a few reasons:

If an employee is terminated: you'll receive their deposit back the month after their termination or after their grace period ends, if you offer a grace period. The deposit will show as a negative amount on your invoice CSV. Learn more about charges for terminated employees.

If an employee is hired: you'll be charged a deposit for the new employee.

If an employee’s allocation is increased: the employee’s deposit will increase.

If an employee’s allocation is reduced: the employee’s deposit will decrease. The difference will show as a negative amount on your invoice CSV.

If a rollover period starts or ends: The employee’s deposit will include the current year’s allocation and the rollover allocation from the previous plan year. If any spending account funds expire, we’ll credit you for the expired amount in the following month.

If you allow a grace period at the end of your plan year: Your spending account allocation from the previous plan year and the spending account allocation from the new (current) year are used to calculate the deposit during the grace period. We’ll credit the grace period's deposit to you the month after the grace period ends.

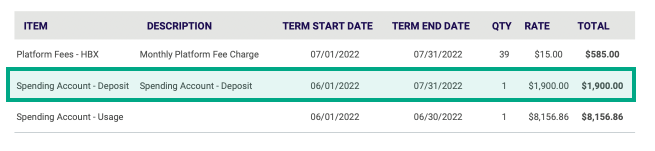

What does it look like on my PDF invoice?

On your PDF invoice, you’ll see a line item called “Spending Account - Deposit”.

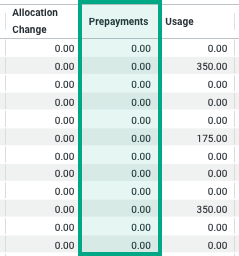

What does it look like on my invoice CSV?

On your invoice CSV, you’ll see the total spending account deposit referred to as “prepayments” and broken down by spending account type and by employee.

What happens to my spending account deposit when my policy renews?

We hold your spending account deposit until the end of your plan year.

There are four different things that can happen to your spending account deposit when your new plan year starts:

Scenario #1: You don’t have rollover or a grace period

We start calculating the new plan year allocation once your new plan year starts

Scenario #2: Unspent funds rollover into the new plan year

We only keep the deposit for any spending account allocation that rolls over into the new plan year.

We continue charging a deposit for these rolled over funds until they expire.

We credit you the deposit for any unspent funds once they expire.

For example, imagine you give an employee $500 in an LSA in 2022. The spending account deposit is $83.3 for the employee on your invoice ([$500 / 12] x 2). In 2023, after the grace period ends, the employee has $200 in unspent LSA funds that rollover. We keep $33.3 of the 2022 spending account deposit for the rolled over amount ([$200 / 12] x 2), and give you a $50 spending account credit on your invoice for the funds the employee spent in 2022 ($83.3 - $33.3).

Scenario #3: You offer a grace period

We'll charge a deposit during the grace period for spending account allocations from the last plan year and the current plan year.

Once the grace period ends, we'll credit the deposit for any unspent allocation amount from the past year that expired.

Scenario #4: You offer a grace period and unspent funds rollover into the new plan year

We keep the deposit for any spending account allocation that rolls over into the grace period and into the new plan year, until the funds expire.

We credit you the deposit for any unspent funds once they expire.

.png)