What is a Lifestyle Spending Account (LSA)?

A Lifestyle Spending Account (LSA) is a flexible account that helps you live your healthiest life. You can use the money in this account to buy a variety of lifestyle and wellness products and services. Continue reading to learn all about how a LSA works.

What you need to know

Your employer decides what expenses are covered

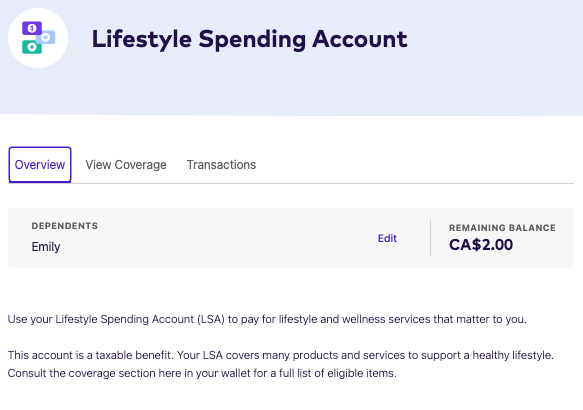

It’s considered a taxable benefit

Your dependents can use the money too!

Find out what’s covered

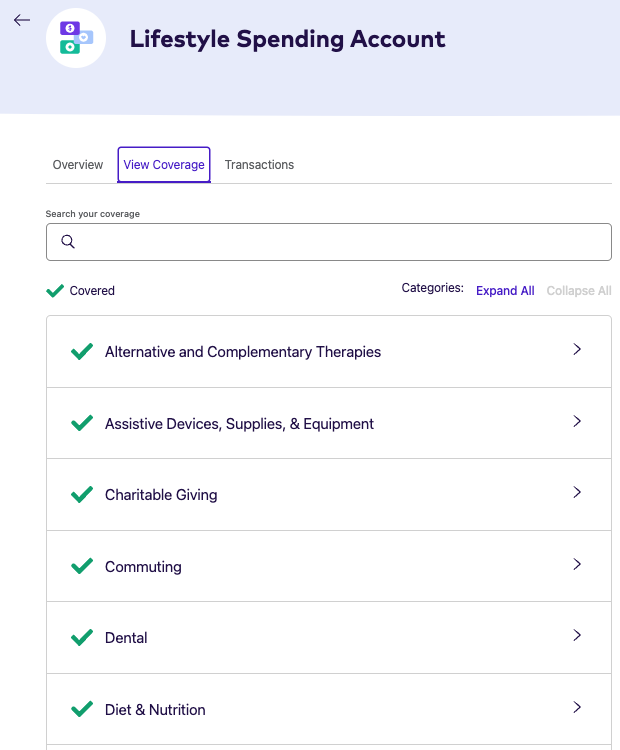

LSAs can cover a huge variety of products and services. Some examples of categories that might be covered are:

Fitness (like gym memberships)

Pet products & services (like vet bills)

Vacationing (like plane tickets)

Keep in mind these are just examples. Your benefits plan is unique, and your employer decides what categories and items are covered. An entire category may not be covered, or some expenses within a category won’t be covered while others are.

Understand how you’ll be taxed

LSAs are considered a taxable benefit. What does this mean? You’ll be taxed on any money you spend from this account because it’s considered additional income.

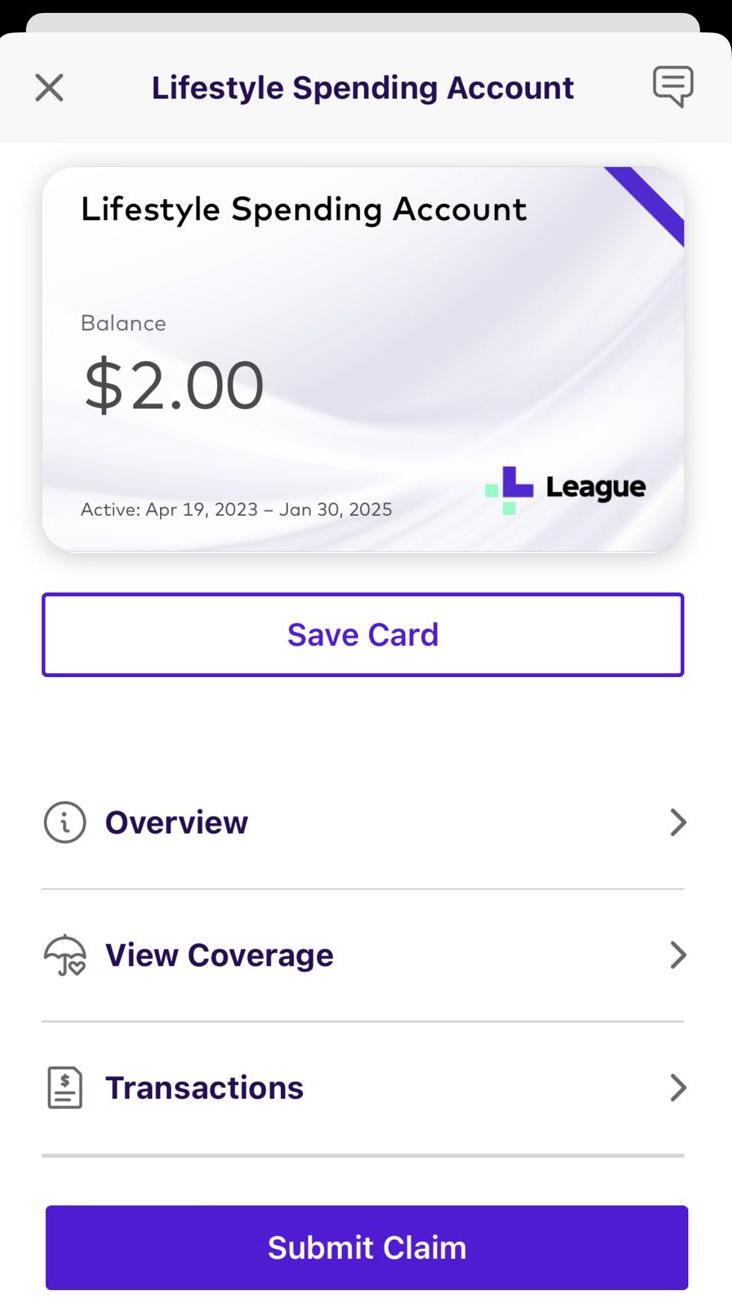

Submit claims

To spend the money in your LSA, make a purchase and submit a picture of the receipt and any other required information in your League Wallet.

Some things to remember:

You can only use your LSA to reimburse money you’ve already spent.

Before submitting a claim to your LSA, check if the expense is also covered by your benefits plan. If it is, you should always submit the claim to your carrier first!

Claims must be for eligible expenses that you paid for after your benefits became active (if you’re a new hire) or during your current plan year (if you’re an existing employee). For example, if your new plan year started in 2020 and you got new money in your LSA, you can’t use this new money to cover 2019 expenses.

Spend on your dependents

You can also spend the money in your LSA on your dependents. The balance in your LSA is the total amount available for you and all your dependents (not the amount available for each person). There’s nothing special you need to do when submitting a claim for a dependent’s expense, just submit as you normally would!

.png)